What Happens to Bonds When Interest Rates Fall

Bonds fall when interest rates rise because of the inverse relationship between rates and yields. That relationship is ane that'south difficult for most investors to understand, and one they haven't had much experience with in recent years amongst consistently low rates. But the impact of rising rates on bond yields is important to sympathise – and be set for it – because sooner or later, interest rates will in fact go upwardly.

Rising Yields Volition Lower Bond Prices

What, yous are asking yourself, bonds can actually fall in cost if yields rise? This seems incorrect equally higher interest rates should create more income on a bond investment.

After the last 30 years of failing interest rates, nearly people are now used to bail prices increasing. They are non prepared to see some pretty large drops in outstanding bond prices with sustained increases in bail yields. The danger to bail prices is much higher than at whatsoever time in recent memory with the extremely low yields in the bond market, which make bonds more sensitive to changes in yields.

This is quite unsafe, as nigh bond traders and investors accept little experience with rising interest rates. The last period of sustained increases in interest rates was from 2003 to 2008 when the U.Southward. Federal Reserve tightened monetary policy. Many current bond traders and bail portfolio managers have only known conditions of loose budgetary policy and falling yields in the years since the 2008 credit crisis. Few call back the bond market place routs of the late 1970s or the sell offs in 1994 and 1998.

Given the lack of investor experience with rising yields, here is a primer on the changed relationship between prices and yields.

Why Bond Prices Alter With Yields

So why practise bond prices modify with changes in prevailing interest rates? This is like shooting fish in a barrel to sympathise if you think near the human relationship between outstanding bond coupon payments and the coupons of new bonds issued at electric current interest rates. It'due south of import to remember that most bonds are "stock-still income investments" and take a fixed coupon that is payable until maturity.

For instance, the electric current "benchmark" Regime of Canada 10 twelvemonth bond is the ii.25% which matures on June 1st, 2025. This bail was issued June 19th, 2014 and anyone who bought information technology on issue gave the Government of Canada $98.85 in exchange for $2.25 per yr in involvement (actually $ane.125 semi-annually) until the chief of $100 is repaid at maturity. Nigh bonds are not issued exactly at $100 since issuers choose a coupon that is a circular number and this bail was issued at a chip of a discount to attain the ii.25% coupon.

How Bond Prices are Adamant

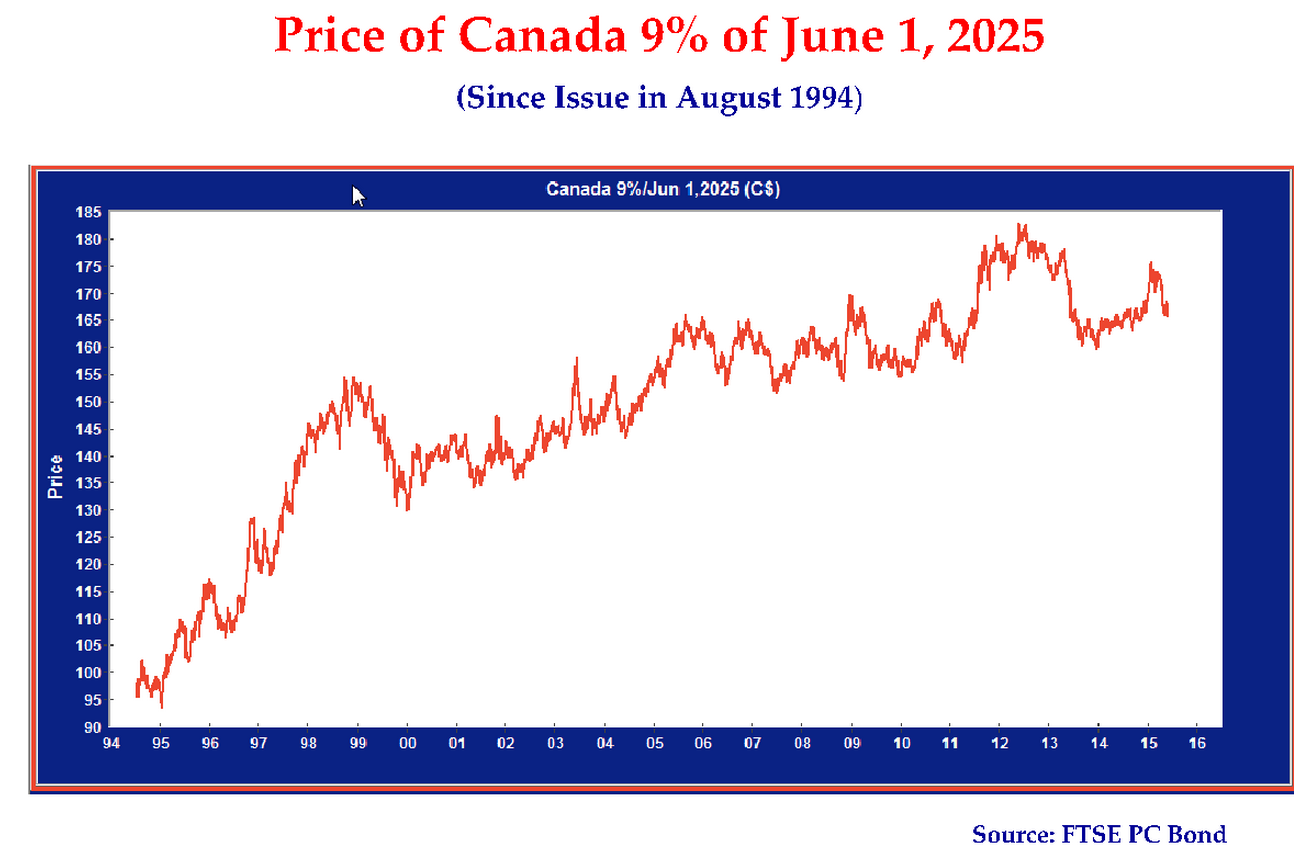

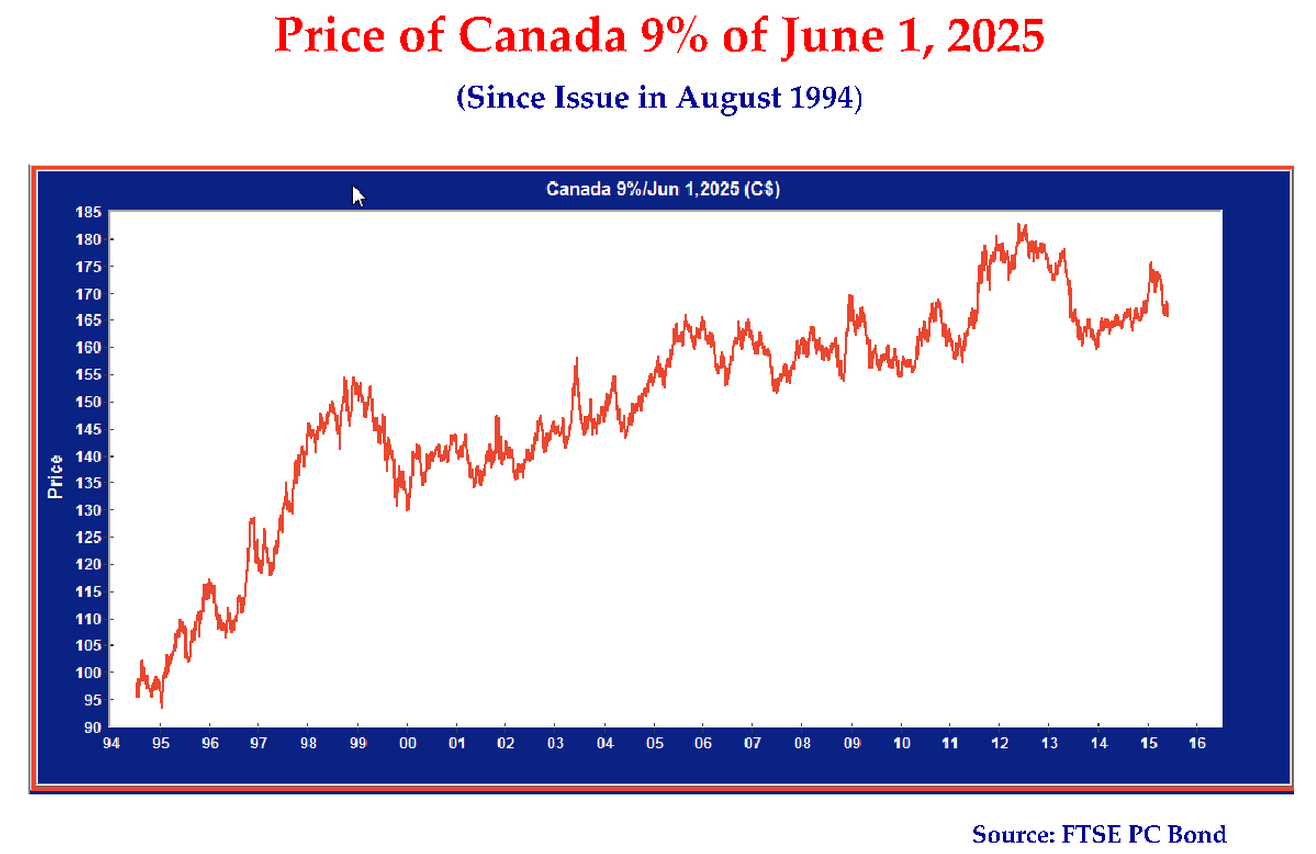

The current market toll of this bail depends on the prevailing yields in the bail market. When this bail was issued, the prevailing 10-twelvemonth bail yield was a bit over 2.25% so this bond was issued at $98.85, the corporeality the investor gave to the government at the time. We have graphed beneath the price of this bond since it was issued to the fourth dimension of writing in early June 2015.

What Goes Upwards, Might Go Downward

Note that it actually started to merchandise at $99 and fell to a low of $98 as bond yields rose after its issue. Yields then savage in the bond marketplace and the price then rose to above $101 before falling back to $99 in mid September 2014. Now look at the strong run up in price to a peak of most $110 in early February 2015, an increment of $11 or 11% as bond yields fell to generational lows on deflation worries. People who held this bond were probable pretty happy with their price appreciation. Now they could be questioning their investment, every bit the toll has dropped dorsum to $104, a decrease of 5% from the peak price of $110 due to rising bond market place yields.

Now that you have seen the evidence that bond prices do indeed alter inversely with bond market place yields, let's think well-nigh why this is. Let's say you lot had bought this 2.25% bail with a maturity date of June 2025 at $98.85 on issue in June 2014 simply yous had to sell it a month later in July 2014. Nosotros know from the price in the chart -above that the price vicious to $98 at that fourth dimension.

Buyers Need the Same Yield

Recollect about what was going on here. Bail market yields had increased so someone could buy a bond issued by the Authorities of Canada with the aforementioned maturity date and become a higher yield of 2.4%. Even though y'all paid $98.85 for your bond, a buyer of your bail wouldn't care what you lot paid, they would demand the same yield as everyone was getting. To increment the yield to maturity, a person buying your bail would offer you less than what you paid. A "discount" of $1 to $98.75 would mathematically enhance the yield of your bond to the required 2.4%. An easy manner to figure this out, not taking into account present value discounting, is that with 10 years to become, a $ane price discount works out to $.10 a year ($1/x years) or .i% per year. Adding the .ane% annualized price appreciation to the coupon of 2.25% gives a 2.35% "yield to maturity".

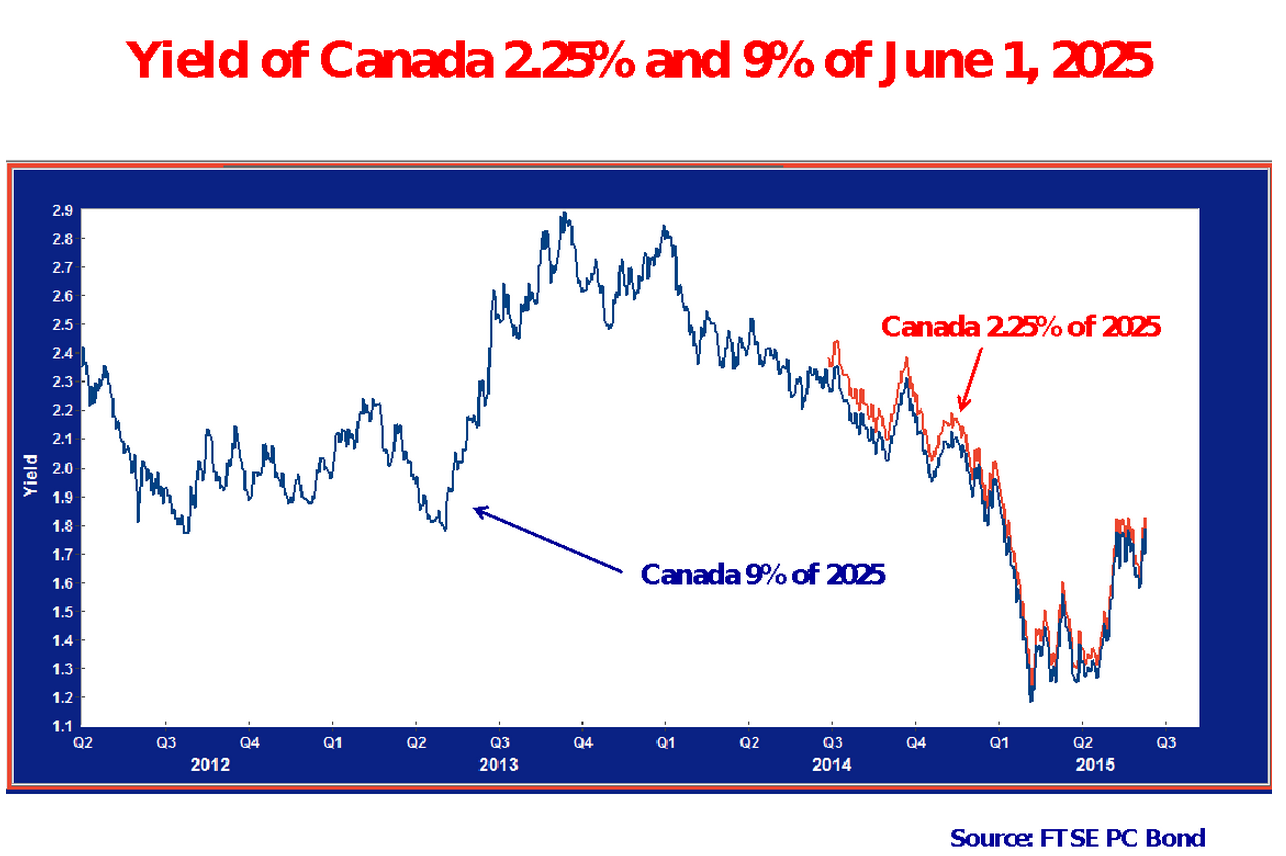

Government of Canada bonds all have the aforementioned "promise to pay" or creditworthiness so investors say they are "fungible". This means they really don't intendance which bond they concur, every bit long every bit the yield is the same and it'due south a Canadian regime credit adventure. Don't believe us? Have a wait at the graph below. We bear witness the yield of the 2.25% of June 2025 Canada bond below in red. The blue line is the yield of the Canada 9% of June 2025.

Swinging Bonds

The 9% Canada of June 2025 was issued in June 1994 as a 31-year bond and now has 10 years to go until maturity. Discover how close the yields are on these two bonds fifty-fifty though in that location is a 7% difference in their coupon. The chart higher up is also interesting in that it shows the broad swings in bond yields during the 3 years since June 2012. Yields were declining during the Euro Debt Crunch in 2011 to 2012 and hit a depression of 1.8% in June 2013. They then shot upwardly to ii.9% in the "Taper Tantrum" of late 2013 when the Federal Reserve announced the gradual end of its bond buying "Quantitative Easing".

Of grade, just when everyone thought yields were going up, they started to plunge in 2014 to make a new historical low of 1.2% in February 2015. At current yields, a 10-year bail moves about 7% in cost for each one% change in its yield. This means that an outstanding Canada bond would have moved up in toll by 12% (1.7% x seven) from its 2.9% yield in tardily 2013 to its lowest yield of 1.2% in February of 2015.

Then we know from the graph above that the yield of the ix% of 2025 Canada bond is pretty well the same equally our 2.25% of 2025 Canada bond with the same maturity engagement. How would we cost the 9% bond to reflect the much higher coupon? Thinking about it as we did earlier, we would become an extra $half-dozen.75 per year (9%-2.25% = half-dozen.75%) or a total of $67.50 over the next 10 years. Not taking into account the compounding and the "time value of money", we should probably pay about $167.fifty for this bond.

Great Guess!

As tin can exist seen in the toll chart in a higher place, the cost of the 9% of 2025 Canada bail was actually $165.75 at the time of writing on June 5th, 2015. The slightly lower toll than our "guesstimate" reflects the compounding of bond yields. We also prove the price of this bond since its issue on Baronial 8th, 1994 to evidence dramatically what happens to an outstanding bond with changing bond market yields. Annotation that this bond was beginning issued at $98.21 when thirty-year bond yields were above 9%. At present, 20 years afterward, with much lower bond market yields, this bail peaked at $182.38 in July 2012.

Nowhere But Upward

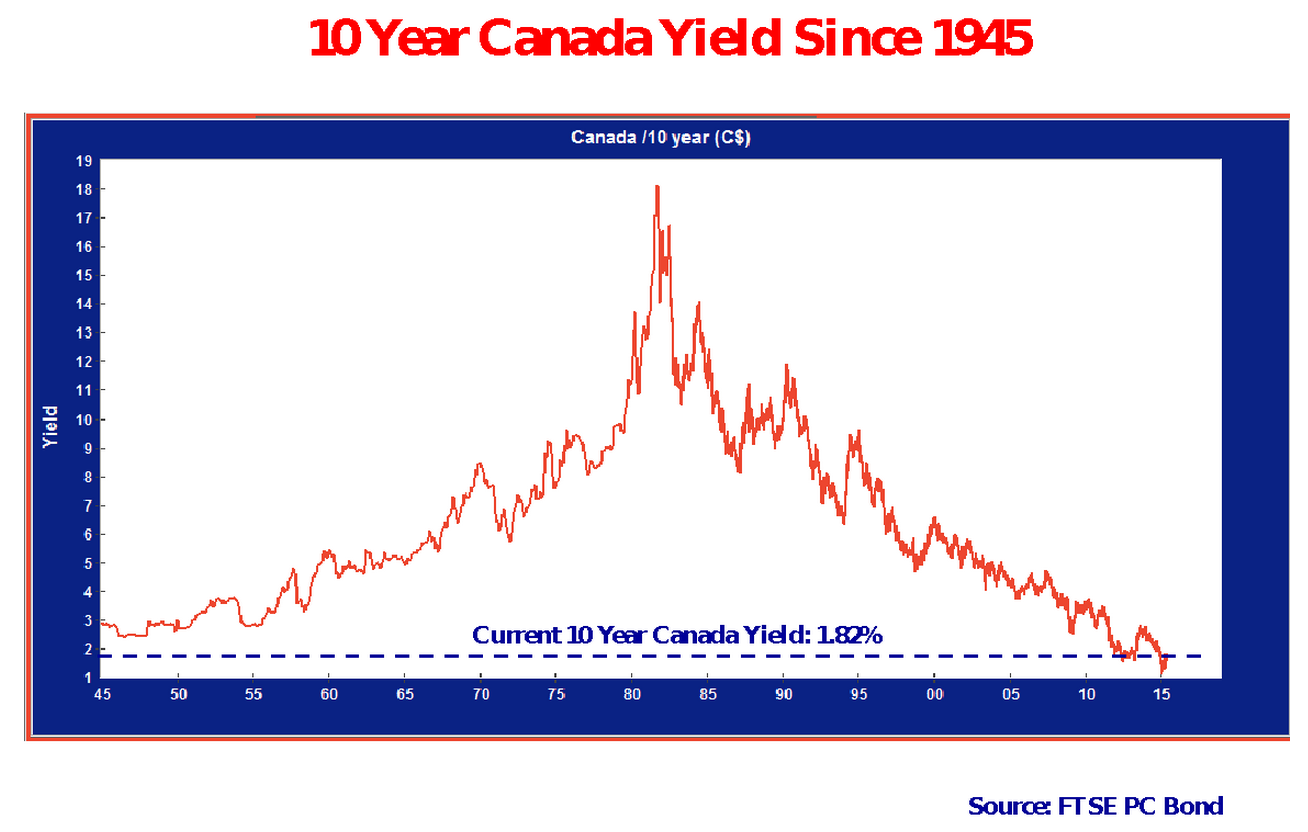

So you now sympathise that outstanding bonds modify in price based on the prevailing interest rates and bond market yields. The real question is where practise bond yields become from here. The chart below shows the yield on x-year Canada bonds since 1945. Note that the current one.viii% is lower than at whatsoever fourth dimension since 1945 so a reasonable person would think that yields have nowhere to go but up.

Another Reason to Worry

There is another reason to worry about rising bond yields. Over long periods, Treasury Bills, the safest stock-still income investment, tend to have yields about ii% to a higher place aggrandizement. The Bank of Canada, Canada'south fundamental bank, has been very successful in its mandate to proceed inflation at an average of 2%. This suggests to united states of america that T-Bills should exist about 4% and a x-yr bond would take a 1% term premium putting the "normalized" yield at 5%.

Be Prepared for Rising Yields

Every bit we said before, a current ten-year bond would fall 7% for each 1% increase in yield. A move to 5% yields from the current 1.8% would mean a 21% decline in the price of all outstanding x-twelvemonth Canada bonds. Will this happen? Perhaps, but bail markets have a manner of humbling people who make predictions on involvement rates and yields.

On the other hand, if you're looking for a condom and secure investment, there'south a lot of risk in the bond market! The problem with ascent yields is that once investors see the downside to bonds, we call up there will exist a lot of selling. Now that you understand the inverse relationship between bond prices and yields, yous are now prepared and forewarned.

Practiced Content from bail portfolio managing director John Carswell, CIO of Canso Investment Counsel Ltd

Source: https://www.financialpipeline.com/what-happens-bonds-interest-rates-rise/

0 Response to "What Happens to Bonds When Interest Rates Fall"

Post a Comment